Eaton Corp Plc (ETN)

376.00

+0.07 (0.02%)

NYSE · Last Trade: Mar 2nd, 3:23 PM EST

Detailed Quote

| Previous Close | 375.92 |

|---|---|

| Open | 369.84 |

| Bid | 375.85 |

| Ask | 376.14 |

| Day's Range | 367.62 - 377.79 |

| 52 Week Range | 231.85 - 408.45 |

| Volume | 1,142,150 |

| Market Cap | 145.85B |

| PE Ratio (TTM) | 35.95 |

| EPS (TTM) | 10.5 |

| Dividend & Yield | 4.160 (1.11%) |

| 1 Month Average Volume | 3,126,686 |

Chart

About Eaton Corp Plc (ETN)

Eaton Corp Plc is a global power management company that specializes in providing energy-efficient solutions to help customers manage electrical power more effectively. The company offers a diverse range of products and services across various sectors including electrical distribution, industrial automation, hydraulic systems, and vehicle solutions. Eaton focuses on innovation and sustainability, developing technologies that optimize energy usage, enhance grid reliability, and enable the integration of renewable energy sources. Through its commitment to empowering businesses and communities, Eaton aims to create a more sustainable environment and improve overall operational efficiency. Read More

News & Press Releases

As of March 2, 2026, the American financial landscape has fractured into two distinct realities. On one side, the S&P 500 index has crossed the psychological threshold of 7,000, fueled by an unprecedented surge in artificial intelligence monetization and a regulatory environment favoring corporate expansion. For the investor

Via MarketMinute · March 2, 2026

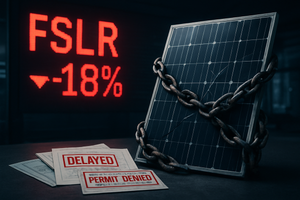

The domestic renewable energy sector was sent into a tailspin this past week as First Solar (NASDAQ: FSLR) issued a surprisingly conservative financial outlook for 2026, triggering a massive 18% sell-off in its shares. The Tempe, Arizona-based manufacturer, long considered the crown jewel of American solar production, stunned investors by

Via MarketMinute · March 2, 2026

Although Cintas has lagged behind its peers over the past year, Wall Street analysts maintain a moderately optimistic outlook on the stock’s prospects.

Via Barchart.com · March 2, 2026

Emerson Electric has underperformed other industrial stocks over the past year, but analysts remain moderately optimistic about the stock’s growth potential.

Via Barchart.com · March 2, 2026

Intelligent power management company Eaton (NYSE:ETN) today announced that David Foster has been named executive vice president and chief financial officer, effective March 2, 2026. He succeeds Olivier Leonetti who will be leaving Eaton on March 13, 2026, as part of a planned transition.

By Eaton · Via Business Wire · March 2, 2026

Hyperscalers are spending massively on capital expenditures this year, and this industrial power and cooling company stands to benefit.

Via The Motley Fool · February 27, 2026

The fourth-quarter 2025 earnings season has delivered a definitive verdict on the health of the American economy: the "Industrial Renaissance" is no longer a forecast, but a realized phenomenon. While broad market indices showed cautious optimism, the Industrial sector shattered expectations, posting a staggering 27% year-over-year earnings growth. This surge

Via MarketMinute · February 27, 2026

Via Benzinga · February 27, 2026

The S&P 500 Index climbed toward a historic psychological threshold on Thursday, closing at 6,946.13 as investors shook off early-year volatility to chase the next major market milestone. The 0.8% daily gain reflects a resilient appetite for equities, driven by a "second wave" of artificial intelligence

Via MarketMinute · February 26, 2026

The Board of Directors of intelligent power management company Eaton (NYSE:ETN) today declared a quarterly dividend of $1.10 per ordinary share, an increase of 6% over its last quarterly dividend. The dividend is payable March 27, 2026, to shareholders of record at the close of business on March 10, 2026. Eaton has paid dividends on its shares every year since 1923.

By Eaton · Via Business Wire · February 26, 2026

Although Eaton has underperformed its industry peers recently, analysts remain moderately optimistic about the stock’s prospects.

Via Barchart.com · February 26, 2026

MENLO PARK, CA — In a move that signals a tectonic shift in the artificial intelligence hardware market, Advanced Micro Devices, Inc. (NASDAQ: AMD) and Meta Platforms, Inc. (NASDAQ: META) announced a definitive multi-year agreement today, February 24, 2026, to deploy up to 6 gigawatts (GW) of GPU capacity across Meta’

Via MarketMinute · February 24, 2026

Via Benzinga · February 23, 2026

The dream of a "pivot" to lower interest rates in early 2026 has been dealt a staggering blow following the release of the latest Personal Consumption Expenditures (PCE) price index. On February 23, 2026, investors are grappling with data that confirms inflation is not merely "sticky" but potentially re-accelerating, forcing

Via MarketMinute · February 23, 2026

Via Benzinga · February 23, 2026

Under certain market and economic conditions, Morgan Stanley's stock could rise even further.

Via The Motley Fool · February 20, 2026

Edison EIX Q4 2025 Earnings Call Transcript

Via The Motley Fool · February 18, 2026

Via MarketBeat · February 18, 2026

Auto insurance provider Mercury General (NYSE:MCY) announced better-than-expected revenue in Q4 CY2025, with sales up 11.3% year on year to $1.54 billion. Its GAAP profit of $3.66 per share was 43% above analysts’ consensus estimates.

Via StockStory · February 17, 2026

On February 11, 2026, the financial markets witnessed a historic milestone for one of America’s most storied industrial giants. Caterpillar Inc. (NYSE: CAT) saw its stock price surge to an all-time high, closing at $775.00 after an intraday peak of $775.54. This rally, which saw the stock

Via MarketMinute · February 17, 2026

Copper futures drifted lower this week, settling near the $5.90 per pound mark as the global commodities market grapples with a seasonal slowdown in China. As the world’s largest consumer of the "red metal," China’s transition into the Lunar New Year holiday has led to a significant

Via MarketMinute · February 16, 2026

Michigan property owners can now trust Gary’s Heating Services for prompt, professional, and affordable HVAC services. The experts deliver comprehensive heating and cooling services to homes and businesses in Lansing, DeWitt, Portland, Eaton County, Ingham County, and other surrounding regions across the state.

Via ReleaseWire · February 13, 2026

The infrastructure of artificial intelligence reached a fever pitch today as shares of Vertiv Holdings Co. (NYSE: VRT) surged 23%, hitting a record high of $248.51. The market’s explosive reaction followed a Q4 2025 earnings report that blew past even the most bullish Wall Street projections, signaling that

Via MarketMinute · February 12, 2026

The technology sector has officially entered the era of the "Gigawatt Supercycle." As of February 12, 2026, new financial projections indicate that the world’s six most aggressive AI infrastructure spenders are on track to exceed a combined $500 billion in capital expenditures this year alone, with some analysts now

Via MarketMinute · February 12, 2026

As of February 11, 2026, the global financial community is fixated on the S&P 500 (INDEXSP: .INX) as it battles to secure a foothold above the historic 7,000-point milestone. After a relentless multi-year rally fueled by the transition from artificial intelligence speculation to large-scale industrialization, the index has

Via MarketMinute · February 11, 2026