Meta Platforms, Inc. - Class A Common Stock (META)

660.57

-7.16 (-1.07%)

NASDAQ · Last Trade: Mar 5th, 5:26 PM EST

Detailed Quote

| Previous Close | 667.73 |

|---|---|

| Open | 661.93 |

| Bid | 658.62 |

| Ask | 659.00 |

| Day's Range | 650.31 - 670.70 |

| 52 Week Range | 479.80 - 796.25 |

| Volume | 13,292,479 |

| Market Cap | 1.90T |

| PE Ratio (TTM) | 40.40 |

| EPS (TTM) | 16.4 |

| Dividend & Yield | 2.100 (0.32%) |

| 1 Month Average Volume | 13,084,305 |

Chart

About Meta Platforms, Inc. - Class A Common Stock (META)

Meta Platforms Inc is a technology company that focuses on building and connecting social media platforms and virtual experiences. It is best known for its flagship products, which include Facebook, Instagram, and WhatsApp, providing users with a space to communicate, share content, and engage with diverse communities. The company is also heavily invested in the development of augmented reality and virtual reality technologies, aiming to create immersive environments and enhance social interaction in the metaverse. Through its various platforms and initiatives, Meta seeks to empower individuals and businesses while fostering new ways for people to connect and collaborate. Read More

News & Press Releases

In the opening months of 2026, the technology sector witnessed a dramatic "tale of two tapes." Driven by monumental breakthroughs in autonomous "agentic" AI from Meta Platforms Inc. (NASDAQ: META) and the private heavyweight Anthropic, tech stocks initially surged to record highs, fueled by the promise of AI that could

Via MarketMinute · March 5, 2026

The semiconductor giant Nvidia (NASDAQ: NVDA) found itself at the center of a market storm this week as its stock plummeted 5.5% in a single trading session, despite delivering what analysts called a "triple beat" in its fiscal fourth-quarter earnings report. The drop, which occurred on February 26, 2026,

Via MarketMinute · March 5, 2026

In a trading session defined by red ink and rising geopolitical anxieties, Broadcom Inc. (NASDAQ: AVGO) emerged as a singular beacon of resilience. The semiconductor giant saw its shares climb 4.8% on March 5, 2026, a sharp divergence from a broader market that buckled under the weight of escalating

Via MarketMinute · March 5, 2026

Via Talk Markets · March 5, 2026

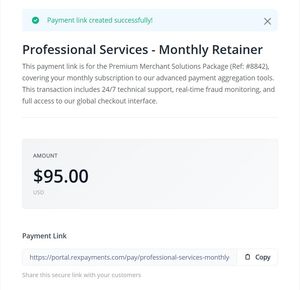

RexPayments, a leading global payment processor aggregator trusted by over 2,000 merchants, today announced the launch of Payment Links . This versatile new feature allows businesses to accept payments instantly through shareable, secure URLs, bypassing the need for a complex e-commerce checkout or dedicated website integration.

Via Get News · March 5, 2026

The "sell the news" fever that has gripped AI-adjacent technology stocks claimed its latest victim on March 5, 2026. Ciena Corp (NYSE: CIEN), a leader in optical networking and the "plumbing" of the modern internet, saw its stock price plunge over 14% in heavy intraday trading. This sharp decline came

Via MarketMinute · March 5, 2026

As the closing bell approaches on March 5, 2026, all eyes on Wall Street are fixed on Marvell Technology (NASDAQ:MRVL), which is set to report its fiscal fourth-quarter 2026 earnings after the market close. In a trading session characterized by heightened sensitivity to artificial intelligence (AI) capital expenditure, Marvell

Via MarketMinute · March 5, 2026

As the first quarter of 2026 draws to a close, a seismic shift in investor sentiment has fundamentally reshaped the landscape of the New York Stock Exchange and the Nasdaq. After three years of relentless enthusiasm for artificial intelligence software and generative models, the market has entered what analysts are

Via MarketMinute · March 5, 2026

In addition to their impressive stock price rises over the years, each of these disruptive tech companies puts some money directly into their shareholders' pockets.

Via The Motley Fool · March 5, 2026

As of March 5, 2026, the technology sector is undergoing a massive "Second Wave" of growth, driven by a fundamental shift from experimental artificial intelligence to the deployment of autonomous "AI Agents." This transition, spearheaded by recent breakthroughs from Meta and Anthropic, has catalyzed a significant market rebound, pushing the

Via MarketMinute · March 5, 2026

The global credit markets have delivered a resounding vote of confidence in the future of artificial intelligence, as Alphabet Inc. (NASDAQ: GOOGL) successfully raised $20 billion through a massive U.S. dollar bond sale that saw investor demand exceed $100 billion. The offering, which closed in late February and has

Via MarketMinute · March 5, 2026

Broadcom Inc. (NASDAQ: AVGO) delivered a powerful signal to the financial markets on March 4, 2026, reporting fiscal first-quarter earnings that surpassed analyst expectations and underscored its pivotal role in the second wave of the artificial intelligence (AI) revolution. As the market entered 2026, investors were laser-focused on whether the

Via MarketMinute · March 5, 2026

Institutional credit investors are more worried about an AI bubble than about AI destroying other companies.

Via The Motley Fool · March 5, 2026

The deals are worth tens of billions each and strengthen each chipmaker's position with the hyperscaler.

Via The Motley Fool · March 5, 2026

As of March 5, 2026, Apple Inc. (NASDAQ: AAPL) stands at a historic crossroads, teetering on the edge of a $4 trillion market capitalization. While the tech giant has long been defined by its hardware prowess and ecosystem "moat," the current narrative is dominated by its transition into a generative AI powerhouse and its strategic [...]

Via Finterra · March 5, 2026

As of March 5, 2026, the global financial landscape is defined by a single architectural force: Nvidia Corp. (NASDAQ:NVDA). With a market capitalization hovering at a staggering $4.4 trillion, Nvidia has transcended its origins as a high-end graphics card manufacturer to become the indispensable utility of the Intelligence Age. The company’s trajectory over the last [...]

Via Finterra · March 5, 2026

Constellation Energy is capitalizing on surging power demand.

Via The Motley Fool · March 5, 2026

While a rotation toward value has already happened, I believe ignoring tech stocks is a mistake.

Via The Motley Fool · March 5, 2026

Arete downgraded the tech giant from ‘Buy’ to ‘Neutral’ and slashed its price target for the stock to $676 from $732.

Via Stocktwits · March 5, 2026

Certain Wall Street analysts see substantial upside in Meta Platforms and Atlassian.

Via The Motley Fool · March 5, 2026

AI-fueled growth should help this tech titan join rarified company.

Via The Motley Fool · March 5, 2026

The data center and semiconductor specialist just provided the clearest evidence yet that the AI revolution is on track.

Via The Motley Fool · March 5, 2026

Tech Chips Lead Wall Street Rebound as Broadcom Crushes Estimateschartmill.com

Via Chartmill · March 5, 2026

AMD has had some impressive headlines lately. Nvidia is still the better AI buy.

Via The Motley Fool · March 4, 2026