Recent Articles from MarketMinute

MarketMinute is a dynamic online platform dedicated to delivering real-time stock news and market insights to investors and enthusiasts alike. Operated by FinancialContent, a leading digital publisher in financial news, the website offers up-to-the-minute updates on stock movements, corporate earnings, analyst ratings, and macroeconomic trends that shape the financial landscape.

Website: https://www.marketminute.com

The United States merger and acquisition (M&A) landscape has entered a transformative era in early 2026, marking a definitive end to the deal-making drought that plagued the previous two years. Driven by a relentless AI supercycle and a dramatic shift toward "regulatory pragmatism," the market is witnessing what analysts

Via MarketMinute · February 12, 2026

OSLO, Norway — Tesla, Inc. (NASDAQ: TSLA) is facing a historic reckoning in the European theater as registration data for the first quarter of 2026 reveals a catastrophic collapse in demand across its most critical strongholds. Once the undisputed king of the electric vehicle (EV) revolution, the Austin-based automaker is now

Via MarketMinute · February 12, 2026

As of February 12, 2026, the semiconductor industry has officially entered what analysts are calling the "Giga-cycle," with global Wafer Fab Equipment (WFE) spending projected to hit an unprecedented $135.2 billion this year. This revised forecast, spearheaded by reports from SEMI and echoed by industry leaders, represents a staggering

Via MarketMinute · February 12, 2026

On February 11, 2026, Meta Platforms Inc. (NASDAQ: META) officially broke ground on a sprawling $10 billion data center campus in Lebanon, Indiana, marking a monumental shift in the company’s infrastructure strategy. The 1-gigawatt (1GW) facility, situated within the state’s burgeoning LEAP Research and Innovation District, is designed

Via MarketMinute · February 12, 2026

In a dramatic shift for the networking giant, Cisco Systems (NASDAQ: CSCO) saw its stock price crater by 11.6% on February 12, 2026, marking one of its steepest single-day declines in years. The sell-off followed an earnings report that, on the surface, appeared robust, with the company beating both

Via MarketMinute · February 12, 2026

EL SEGUNDO, CA — Shares of toy powerhouse Mattel, Inc. (NASDAQ: MAT) experienced a devastating sell-off on February 12, 2026, plummeting 24% in a single trading session. The move comes on the heels of a disastrous fourth-quarter earnings report and a fiscal year 2026 outlook that left Wall Street questioning the

Via MarketMinute · February 12, 2026

As of February 12, 2026, the financial landscape has undergone a tectonic shift, with the healthcare sector decisively seizing the mantle of market leadership. After years of dominance by high-flying technology giants, investors have executed a massive "Great Rotation," fleeing overextended tech valuations in favor of the stability and renewed

Via MarketMinute · February 12, 2026

In a decisive move that has sent ripples through the semiconductor sector, Micron Technology (NASDAQ: MU) shares rocketed nearly 10% on Wednesday, closing at a record $410.34. The surge was fueled by an announcement that the Idaho-based memory giant has officially entered volume production for its next-generation HBM4 (High

Via MarketMinute · February 12, 2026

On February 12, 2026, the financial markets presented a stark dichotomy between fundamental corporate strength and cautious investor sentiment. While Apple Inc. (NASDAQ: AAPL) continues to ride the crest of a massive “AI supercycle” fueled by its latest iPhone 17 lineup, the broader market’s appetite for mega-cap technology stocks

Via MarketMinute · February 12, 2026

The edge computing landscape underwent a seismic shift today as shares of Fastly, Inc. (NYSE: FSLY) surged as much as 44% in early trading, following a fourth-quarter earnings report that far exceeded Wall Street’s expectations. The massive technical breakout, which saw the stock reclaim levels not seen in years,

Via MarketMinute · February 12, 2026

As the artificial intelligence arms race accelerates, the physical limitations of the power grid have become the primary bottleneck for tech giants. In a bold move to bypass these constraints, Microsoft (NASDAQ: MSFT) has begun pilot testing High-Temperature Superconductor (HTS) power lines for its next-generation data centers. This "lossless" technology,

Via MarketMinute · February 12, 2026

In a move that has sent shockwaves through the global financial markets, the American investment giant Nuveen, the asset management arm of TIAA, announced today, February 12, 2026, a definitive agreement to acquire the historic British asset manager Schroders PLC (LON: SDR) for $13.5 billion (£9.9 billion). The

Via MarketMinute · February 12, 2026

The high-flying momentum of the early 2020s tech recovery hit a significant roadblock on February 12, 2026, as International Business Machines (NYSE: IBM) dominated financial headlines for all the wrong reasons. Shares of the "Big Blue" fell 6.5%, plummeting to a range between $260 and $272, making it the

Via MarketMinute · February 12, 2026

Zebra Technologies (NASDAQ: ZBRA) dominated the market discourse on February 12, 2026, as its shares rocketed 14% higher following the release of an unexpectedly strong fourth-quarter earnings report. The company, a linchpin in the global supply chain, posted revenue of $1.48 billion—surpassing analyst expectations and signaling a definitive

Via MarketMinute · February 12, 2026

The digital infrastructure landscape shifted decisively today as Equinix, Inc. (NasdaqGS: EQIX) saw its shares skyrocket 11.25%, closing near historic highs following a blockbuster earnings report that signaled a new era of growth driven by Artificial Intelligence. Despite a marginal miss on quarterly revenue, the market looked past the

Via MarketMinute · February 12, 2026

The infrastructure of artificial intelligence reached a fever pitch today as shares of Vertiv Holdings Co. (NYSE: VRT) surged 23%, hitting a record high of $248.51. The market’s explosive reaction followed a Q4 2025 earnings report that blew past even the most bullish Wall Street projections, signaling that

Via MarketMinute · February 12, 2026

In a move that signals the definitive end of the "asset-light" era for Big Tech, Alphabet Inc. (Nasdaq: GOOGL) has tapped the debt markets for a staggering $20 billion. The centerpiece of this massive capital raise is a rare 100-year "century bond," a financial instrument not seen from a major

Via MarketMinute · February 12, 2026

The commercial real estate sector, already weathering years of post-pandemic structural shifts, faced a new and formidable adversary this week: artificial intelligence. On Wednesday, February 11, 2026, a wave of "AI Panic Trading" swept through the markets, leading to a historic sell-off for the world’s largest real estate service

Via MarketMinute · February 12, 2026

The S&P 500 is currently hovering at a critical psychological juncture, closing at 6,941.47 on February 11, 2026, as investors set their sights on the elusive 7,000-point milestone. This march toward 7,000 represents a historic acceleration in market value, coming just 14 months after the

Via MarketMinute · February 12, 2026

The U.S. labor market threw a curveball at Wall Street on Wednesday, February 11, 2026, as the January Jobs Report revealed a surprising burst of hiring that fundamentally reshaped the outlook for interest rate cuts this year. Nonfarm payrolls surged by 130,000, nearly doubling the consensus estimate of

Via MarketMinute · February 12, 2026

The opening weeks of 2026 have etched a stark portrait of a "two-speed" economy. As of February 12, 2026, the S&P 500 continues to hover near the historic 7,000-point milestone, but the celebratory headline masks a deep internal fracture. A handful of sectors—primarily high-octane Technology and a

Via MarketMinute · February 12, 2026

The corporate credit markets have been hit by a historic "supply flood" as some of the world’s largest technology firms issued more than $100 billion in new debt during the opening weeks of 2026. This sudden deluge of high-quality paper, driven primarily by the insatiable capital requirements of artificial

Via MarketMinute · February 12, 2026

As the final results of the Q4 2025 earnings season trickle in this February 12, 2026, the S&P 500 has managed to navigate a treacherous path of high expectations and a tightening monetary narrative. Despite initial fears that high interest rates and a cooling labor market would erode corporate

Via MarketMinute · February 12, 2026

In a move that underscores the relentless momentum of the artificial intelligence revolution, Celestica (NYSE:CLS) has significantly upwardly revised its financial targets for the 2026 fiscal year. The Toronto-based electronics manufacturing giant, which has successfully pivoted from a traditional contract assembler to a high-value engineering partner for the world's

Via MarketMinute · February 12, 2026

A dramatic diplomatic pivot by the White House regarding the status of Greenland has sent a wave of relief through global financial markets this week. After a month of escalating tensions that saw the United States threaten aggressive trade barriers against several European allies, the administration has shifted its stance

Via MarketMinute · February 12, 2026

The U.S. labor market is facing a moment of profound reckoning as new data reveals that the economic engine of 2025 was far more sluggish than previously reported. On February 6, 2026, the Bureau of Labor Statistics (BLS) released its annual benchmark revisions, striking a devastating blow to the

Via MarketMinute · February 12, 2026

In a stunning reversal for one of 2025’s top market performers, AppLovin (NASDAQ: APP) saw its shares crater by 20% following its fourth-quarter earnings report on February 11, 2026. Despite posting "beat-and-raise" results that exceeded Wall Street’s expectations for both revenue and earnings, the Palo Alto-based software company

Via MarketMinute · February 12, 2026

As of February 12, 2026, the financial markets are witnessing a dramatic reversal of the decade-long "growth over value" narrative. In the first six weeks of the year, the S&P 500 Energy sector has surged to become the market's undisputed leader, posting a gain of over 14% and significantly

Via MarketMinute · February 12, 2026

As the global economy navigates a complex tapestry of lingering inflation and shifting geopolitical alliances in early 2026, the luxury sector has revealed a stark divide between the merely "premium" and the truly "exceptional." While many high-end brands have spent the last year grappling with price fatigue and a pullback

Via MarketMinute · February 12, 2026

In a trading session characterized by cautious sentiment and macro-inflationary jitters, Zebra Technologies (NASDAQ: ZBRA) emerged as a definitive outlier on February 12, 2026. Shares of the Illinois-based automation leader surged 14.2% following a fourth-quarter earnings report that not only cleared analyst hurdles but fundamentally reset expectations for the

Via MarketMinute · February 12, 2026

Bank of America (NYSE:BAC) has released its highly anticipated 2026 M&A Outlook, signaling a transformative shift in the global deal-making landscape. After years of cautious maneuvering and high interest rates, the bank’s Global Corporate & Investment Banking (GCIB) division characterizes 2026 as a "Powering Up" year. The report

Via MarketMinute · February 12, 2026

Following the release of a robust January jobs report that exceeded all Wall Street expectations, President Donald Trump has reignited his aggressive campaign against current Federal Reserve policy, calling for the United States to implement the “lowest interest rates in the world.” The President’s remarks, punctuated by a celebratory

Via MarketMinute · February 12, 2026

The United States Treasury market was sent into a tailspin this week following a shockingly robust employment report that has fundamentally redrawn the Federal Reserve’s roadmap for 2026. On Wednesday, the 2-year Treasury yield experienced its most violent single-day surge since late 2025, as investors scrambled to price out

Via MarketMinute · February 12, 2026

The enterprise software market is currently grappling with a seismic shift that many are calling the "Software Sector Apocalypse" or the "SaaSpocalypse." As of mid-February 2026, a massive rotation out of legacy software-as-a-service (SaaS) names has wiped hundreds of billions of dollars from the market. Investors, once enamored by the

Via MarketMinute · February 12, 2026

In what is being described by Wall Street analysts as the "AI Scare Trade," the commercial real estate services sector experienced its most brutal day of trading since the 2020 pandemic. On February 11, 2026, a sudden and coordinated exodus from labor-intensive service stocks wiped billions in market capitalization from

Via MarketMinute · February 12, 2026

The global toy industry witnessed a dramatic divergence this week as the two titans of play, Mattel, Inc. (NASDAQ: MAT) and Hasbro, Inc. (NASDAQ: HAS), reported their latest financial results. On February 11, 2026, Mattel shares plummeted 24% following a disappointing holiday season and a cautious outlook for the year

Via MarketMinute · February 12, 2026

In a dramatic reversal of fortune that underscored the insatiable appetite for artificial intelligence infrastructure, shares of Micron Technology, Inc. (Nasdaq: MU) surged nearly 10% on February 11, 2026. The rally, which propelled the stock to a record closing high of $410.34, was ignited by a series of high-stakes

Via MarketMinute · February 12, 2026

The financial world experienced a seismic shift on January 30, 2026, when President Donald Trump nominated Kevin Warsh to succeed Jerome Powell as the Chair of the Federal Reserve. This move, long-telegraphed by the administration but still jarring to global markets, marks the beginning of what analysts are calling the

Via MarketMinute · February 12, 2026

The U.S. labor market just delivered a thunderclap that has reverberated from the halls of the Federal Reserve to the trading floors of Wall Street. In a stunning reversal of the "cooling" narrative that dominated the final months of 2025, the January jobs report released this morning revealed that

Via MarketMinute · February 12, 2026

Wall Street reached a monumental psychological and financial peak on January 28, 2026, when the S&P 500 Index surged to an all-time intraday high of 7,002.28. This historic breach marks the first time the benchmark index has ever crossed the 7,000 threshold, crowning a relentless 14-month

Via MarketMinute · February 12, 2026

The U.S. capital markets have entered a transformative phase in early 2026, as a dramatic shift in federal regulatory policy clears the way for a wave of corporate consolidation unseen in nearly a decade. Following years of aggressive antitrust enforcement and litigation-first strategies that characterized the early 2020s, the

Via MarketMinute · February 12, 2026

TEMPE, AZ — February 12, 2026 — Amkor Technology (NASDAQ:AMKR) has sent shockwaves through the semiconductor industry this week, reporting a fourth-quarter earnings blowout that far exceeded even the most optimistic Wall Street projections. The company posted an earnings per share (EPS) of $0.69, a staggering 60% surprise over the

Via MarketMinute · February 12, 2026

The economic landscape of February 2026 has reached a definitive turning point, as the long-promised "AI dividend" finally manifests in hard macroeconomic data. After years of skepticism regarding the "Solow Paradox"—the idea that computerization was visible everywhere except in productivity statistics—new reports from the Bureau of Labor Statistics

Via MarketMinute · February 12, 2026

The American consumer, long considered the indomitable engine of the global economy, has finally hit a wall. On February 10, 2026, the Department of Commerce released a highly anticipated report revealing that retail sales in the United States were flat—0.0% growth—for the final month of 2025. This

Via MarketMinute · February 12, 2026

The healthcare sector has staged a dramatic structural breakout, ending a multi-year period of relative stagnation to lead the global markets into 2026. After a powerful 10% gain in the final quarter of 2025, the sector has officially surpassed technology and energy to become the top-performing segment of the S&

Via MarketMinute · February 12, 2026

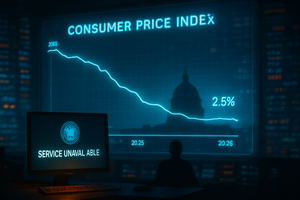

As the calendar turns to mid-February 2026, the American economy stands at a critical juncture. Investors and policymakers are fixated on the upcoming release of the January Consumer Price Index (CPI) report, which is widely anticipated to show a year-over-year inflation rate of 2.5%. This follows a cooling trend

Via MarketMinute · February 12, 2026

The United States labor market delivered a stunning surprise in early 2026, as the Bureau of Labor Statistics (BLS) reported the addition of 130,000 nonfarm payrolls for January. This figure significantly outpaced the consensus estimate of approximately 55,000, signaling a potential reversal of the cooling trend that dominated

Via MarketMinute · February 12, 2026

As the first quarter of 2026 unfolds, the technology sector is asserting its dominance with a vigor that has caught even the most optimistic market spectators by surprise. Following a two-year period characterized by what analysts described as a "necessary digestion" of the explosive gains from the early 2020s, the

Via MarketMinute · February 12, 2026

The technology sector has officially entered the era of the "Gigawatt Supercycle." As of February 12, 2026, new financial projections indicate that the world’s six most aggressive AI infrastructure spenders are on track to exceed a combined $500 billion in capital expenditures this year alone, with some analysts now

Via MarketMinute · February 12, 2026

The United States mergers and acquisitions (M&A) landscape has undergone a tectonic shift in early 2026, marking an emphatic end to the post-pandemic "deal drought." As of February 12, 2026, total deal value has surged by a staggering 111.5% year-over-year, driven by a flurry of transformative "megadeals" valued

Via MarketMinute · February 12, 2026

In a move that reshapes the global financial landscape, Nuveen, the investment management arm of TIAA, has announced a definitive agreement to acquire the storied British asset manager Schroders plc (LSE: SDR) for $13.5 billion (£9.9 billion). The deal, announced today on February 12, 2026, marks the end

Via MarketMinute · February 12, 2026

As the defense sector grapples with the escalating complexities of modern warfare, L3Harris Technologies (NYSE:LHX) has emerged as a standout performer, posting a staggering 73% stock surge over the past twelve months. This rally, which has pushed shares into record territory near the $350 mark, is underpinned by a

Via MarketMinute · February 12, 2026

LONDON/NEW YORK – In a historic shift that has redefined the global financial landscape, gold has decisively breached the $5,000 per ounce milestone for the first time in history. As of February 12, 2026, the yellow metal sits at $4,985, having briefly peaked at a staggering $5,608

Via MarketMinute · February 12, 2026

In a move that underscores the high-stakes reality of the global artificial intelligence "arms race," Alphabet Inc. (NASDAQ: GOOGL) successfully closed a massive $20 billion bond offering this week, meeting a tidal wave of investor appetite that exceeded $100 billion in total orders. The capital raise, which was upsized from

Via MarketMinute · February 12, 2026

As the global economy stabilizes into a period of disinflationary growth, Goldman Sachs (NYSE: GS) has released a robust 2026 stock market outlook, forecasting a 12% total return for the S&P 500. This optimistic projection, which places the index target between 7,200 and 7,600 by year-end, suggests

Via MarketMinute · February 12, 2026

The first two weeks of February 2026 have marked a historic decoupling in the U.S. financial markets, as investors execute a massive "Great Rotation" out of the mega-cap technology giants that dominated the last decade and into the long-neglected domestic small-cap sector. The Russell 2000 Index (IWM) has surged

Via MarketMinute · February 12, 2026

As of February 12, 2026, the technology sector is witnessing the materialization of what many analysts are calling the largest infrastructure commitment in the history of computing. Oracle (NYSE: ORCL) has fully activated its landmark $300 billion, five-year cloud computing contract with OpenAI, a deal that officially positions the legacy

Via MarketMinute · February 12, 2026

In a move that signals the dawn of a new era for independent energy producers, Devon Energy (NYSE:DVN) and Coterra Energy (NYSE:CTRA) announced a definitive $58 billion merger agreement on February 2, 2026. This all-stock "merger of equals" is designed to create a premier large-cap shale operator, specifically

Via MarketMinute · February 12, 2026

In a move that fundamentally redraws the map of the global cybersecurity landscape, Palo Alto Networks (NASDAQ: PANW) has officially closed its $25 billion acquisition of CyberArk. The deal, finalized on February 11, 2026, represents the largest transaction in the history of the security industry and signals a bold shift

Via MarketMinute · February 12, 2026

In a move that fundamentally reshapes the landscape of cloud computing and artificial intelligence, Alphabet Inc. (NASDAQ:GOOGL) has secured unconditional antitrust approval from the European Commission for its landmark $32 billion acquisition of cybersecurity leader Wiz. The decision, handed down on February 10, 2026, removes the last major regulatory

Via MarketMinute · February 12, 2026

As the United States enters the final year of the current Infrastructure Investment and Jobs Act (IIJA) authorization, the construction materials sector is providing a clear window into the nation's physical health. Martin Marietta Materials, Inc. (NYSE: MLM) released its fourth-quarter and full-year 2025 financial results on February 11, 2026,

Via MarketMinute · February 12, 2026

In a landmark move for the global semiconductor industry, Applied Materials (NASDAQ: AMAT) and Samsung Electronics (KRX: 005930) officially inaugurated their joint research residency at the newly minted EPIC Center in Silicon Valley. The announcement, made today, February 12, 2026, positions Samsung as the "founding member" of the $5 billion

Via MarketMinute · February 12, 2026

The financial world witnessed a watershed moment on January 28, 2026, as the S&P 500 index breached the 7,000-point threshold for the first time in history. This milestone, coming just fourteen months after the index crossed the 6,000 mark in November 2024, underscores the relentless momentum of

Via MarketMinute · February 12, 2026

In a bold move to solidify its lead in the race for direct-to-device satellite connectivity, AST SpaceMobile (NASDAQ: ASTS) announced on February 12, 2026, a proposed $1.0 billion offering of convertible senior notes. The capital raise, which was upsized from an initial $850 million due to robust institutional demand,

Via MarketMinute · February 12, 2026

The financial markets were sent into a tailspin on Thursday as S&P Global (NYSE: SPGI) saw its shares slump by nearly 10%, marking one of its steepest single-day declines in recent years. The sell-off was ignited by the company’s release of its 2026 profit forecast, which fell significantly

Via MarketMinute · February 12, 2026

In a move that has sent shockwaves through the critical minerals sector, Albemarle Corporation (NYSE:ALB) announced on February 11, 2026, that it would idle the remaining operational unit at its Kemerton lithium hydroxide plant in Western Australia. The decision to place the facility into "care and maintenance" marks the

Via MarketMinute · February 12, 2026

In a move that underscores its aggressive pivot toward specialized industry clouds, Oracle Corporation (NYSE: ORCL) announced on February 11, 2026, that it has secured a massive, multi-year contract with the Centers for Medicare and Medicaid Services (CMS). The deal tasks Oracle Cloud Infrastructure (OCI) with migrating and managing the

Via MarketMinute · February 12, 2026

In a definitive move that reshapes the landscape of American mortgage finance, PennyMac Financial Services, Inc. (NYSE: PFSI) announced on February 11, 2026, that it has entered into a definitive agreement to acquire the subservicing business of Cenlar Capital Corporation. This $257.5 million deal marks a transformative shift for

Via MarketMinute · February 12, 2026

Gaming and Leisure Properties (NASDAQ: GLPI) officially announced the closing of its $700 million acquisition of the real estate assets belonging to Bally’s Twin River Lincoln Casino Resort in Rhode Island. The deal, which finalized on February 11, 2026, marks one of the most significant regional gaming transactions in

Via MarketMinute · February 12, 2026

PITTSBURGH – In a move that fundamentally reshapes the global rail technology landscape, Wabtec Corporation (NYSE: WAB) announced today, February 12, 2026, the finalization of its acquisition of Dellner Couplers. The $960 million (€890 million) cash deal, which initially cleared regulatory hurdles in late 2025, marks a milestone in Wabtec’s

Via MarketMinute · February 12, 2026

The American consumer, long the indomitable engine of the global economy, appears to have hit a sudden roadblock. Fresh data released by the Commerce Department on February 10, 2026—following a delay caused by a 43-day government shutdown—revealed that retail sales were flat (0.0%) in December 2025. This

Via MarketMinute · February 12, 2026

Alphabet Inc. (NASDAQ: GOOGL) saw its share price decline by 1.8% this week following the announcement and pricing of a massive $20 billion bond sale. The move, while demonstrating the company’s immense credit strength, has ignited fresh anxieties among investors regarding the sheer scale of capital required to

Via MarketMinute · February 12, 2026

In a resounding display of market dominance, shares of Spotify (NYSE: SPOT) surged 14.7% this week, closing at $476.02 after the company released a blockbuster fourth-quarter 2025 earnings report. The rally, which added billions to the company’s market capitalization, was fueled by record-breaking user acquisition and a

Via MarketMinute · February 12, 2026

In a move that signals a seismic shift in U.S. monetary policy, President Donald Trump has formally nominated Kevin Warsh to serve as the next Chair of the Federal Reserve. The announcement, made in late January 2026, sets the stage for a transition of power at the world’s

Via MarketMinute · February 12, 2026

In a dramatic reversal of strategy, The Kraft Heinz Company (NASDAQ: KHC) announced on February 11, 2026, that it is indefinitely pausing its previously detailed plan to split into two independent, publicly traded companies. The decision, revealed during a somber fourth-quarter earnings call, marks a total pivot from the "transformation

Via MarketMinute · February 12, 2026