Shell plc (SHEL)

78.22

-2.01 (-2.51%)

NYSE · Last Trade: Feb 12th, 4:17 PM EST

Detailed Quote

| Previous Close | 80.23 |

|---|---|

| Open | 79.47 |

| Bid | 77.10 |

| Ask | 79.97 |

| Day's Range | 77.63 - 79.60 |

| 52 Week Range | 58.54 - 80.25 |

| Volume | 7,297,423 |

| Market Cap | - |

| PE Ratio (TTM) | - |

| EPS (TTM) | - |

| Dividend & Yield | 2.864 (3.66%) |

| 1 Month Average Volume | 6,438,177 |

Chart

News & Press Releases

As of February 12, 2026, the financial markets are witnessing a dramatic reversal of the decade-long "growth over value" narrative. In the first six weeks of the year, the S&P 500 Energy sector has surged to become the market's undisputed leader, posting a gain of over 14% and significantly

Via MarketMinute · February 12, 2026

Transaction in Own Shares

By Shell plc · Via GlobeNewswire · February 12, 2026

Transaction in Own Shares

By Shell plc · Via GlobeNewswire · February 11, 2026

Shell PLC (NYSE:SHEL) Presents a Compelling Case for Quality Dividend Investorschartmill.com

Via Chartmill · February 10, 2026

As of February 11, 2026, the global energy landscape is teetering on the edge of a significant supply disruption following a series of aggressive maritime interdictions by the United States. On February 9, US naval forces successfully boarded and seized the Aquila II, a crude oil tanker allegedly part of

Via MarketMinute · February 11, 2026

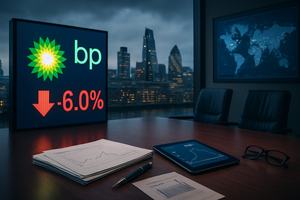

In a move that sent ripples through the global energy sector, BP (NYSE: BP) announced on February 10, 2026, that it would immediately suspend its $750 million quarterly share buyback program. The decision marks a dramatic departure from the company’s recent strategy of aggressive shareholder returns, signaling a pivot

Via MarketMinute · February 10, 2026

Transaction in Own Shares

By Shell plc · Via GlobeNewswire · February 10, 2026

As of February 10, 2026, the global energy landscape finds itself at a crossroads between the urgent demands of decarbonization and the immediate realities of energy security. At the heart of this tension stands BP p.l.c. (NYSE: BP, LSE: BP), a company that has spent the last five years attempting one of the most ambitious [...]

Via Finterra · February 10, 2026

Transaction in Own Shares

By Shell plc · Via GlobeNewswire · February 9, 2026

Via MarketBeat · February 9, 2026

Transaction in Own Shares

By Shell plc · Via GlobeNewswire · February 6, 2026

The global energy market has been jarred by a "violent reversal" in crude oil prices during the first week of February 2026. After a blistering 14% rally in January that saw West Texas Intermediate (WTI) surge to multi-month highs near $67 per barrel, the benchmark has slid approximately 6% in

Via MarketMinute · February 6, 2026

LONDON — Shell, the British energy giant, reported its weakest quarterly profit in nearly five years on February 5, 2026, as a combination of cooling global oil prices and a protracted downturn in the chemicals market finally caught up with the company’s bottom line. The London-based major posted adjusted earnings

Via MarketMinute · February 6, 2026

Today’s Date: February 6, 2026 Introduction As of February 6, 2026, the global energy markets are recalibrating their expectations for the "Supermajors" after a turbulent start to the earnings season. At the center of this storm is Shell PLC (NYSE: SHEL), the London-based energy giant that has long served as a bellwether for the integrated [...]

Via Finterra · February 6, 2026

Shell plc

By Shell plc · Via GlobeNewswire · February 6, 2026

Transaction in Own Shares

By Shell plc · Via GlobeNewswire · February 5, 2026

Shell plc

By Shell plc · Via GlobeNewswire · February 5, 2026

Shell plc Fourth Quarter 2025 Interim Dividend

By Shell plc · Via GlobeNewswire · February 5, 2026

London, February 5, 2026

By Shell plc · Via GlobeNewswire · February 5, 2026

By Shell plc · Via GlobeNewswire · February 5, 2026

High-yield Chevron is built to be reliable in an industry known for volatility.

Via The Motley Fool · February 3, 2026

Exxon Mobil Corporation (NYSE: XOM) reported a blockbuster fourth-quarter earnings result on February 2, 2026, marking a historic year of operational milestones and financial dominance. The energy titan delivered an adjusted earnings per share (EPS) of $1.71, surpassing Wall Street’s consensus of $1.68, even as global energy

Via MarketMinute · February 2, 2026

Global energy markets were thrust into a state of high alert as February 2, 2026, dawned, with Brent crude oil surging to a multi-month peak of $71.00 per barrel. The spike followed a period of intense geopolitical friction, as a massive U.S. naval buildup in the Arabian Sea

Via MarketMinute · February 2, 2026

The books closed on 2025 with the global natural gas market presenting a striking study in regional contrast. While American consumers and industrial users grappled with a sharp 12.1% surge in Henry Hub prices during December, their counterparts in Europe and Australia enjoyed a surprising reprieve. The Dutch TTF,

Via MarketMinute · February 2, 2026