KeyCorp (KEY)

19.69

-0.17 (-0.86%)

NYSE · Last Trade: Mar 9th, 9:13 PM EDT

Banks play a critical role in the financial system, providing everything from commercial loans to wealth management and payment processing services. But conc...

Via StockStory · March 9, 2026

A number of stocks fell in the afternoon session after investors grew increasingly concerned about the sector's exposure to the opaque private credit market.

Via StockStory · March 6, 2026

Kratos stock has potential -- but not near-term potential.

Via The Motley Fool · March 6, 2026

KEYCORP (NYSE:KEY) Shows Strong Technical Health and Bullish Setup Patternchartmill.com

Via Chartmill · January 30, 2026

The release of the January Producer Price Index (PPI) report has sent shockwaves through the financial markets, as wholesale inflation rose a staggering 0.5% for the month, significantly outpacing economist estimates of 0.3%. This unexpected jump, reported by the Bureau of Labor Statistics on February 27, 2026, has

Via MarketMinute · March 2, 2026

The medical clothing supplier has a vast global growth opportunity.

Via The Motley Fool · February 27, 2026

A number of stocks fell in the afternoon session after hotter-than-expected inflation data and rising concerns over credit risk rattled investors. January's Producer Price Index (PPI), a measure of wholesale inflation, rose 0.5% against expectations of 0.3%, with the core component jumping 0.8%. This report fuels the narrative of "sticky inflation," suggesting the Federal Reserve may have limited room to cut interest rates.

Via StockStory · February 27, 2026

As the sun begins to set on Jerome Powell’s tenure at the helm of the world’s most powerful central bank, the financial world is bracing for a tectonic shift in economic governance. The nomination of Kevin Warsh to succeed Powell as Chairman of the Federal Reserve in May

Via MarketMinute · February 24, 2026

As of February 24, 2026, the Bank of Nova Scotia (TSX: BNS; NYSE: BNS), widely known as Scotiabank, finds itself at a pivotal crossroads in its nearly two-century history. Long considered the most international of Canada’s "Big Five" banks, Scotiabank has spent the last two years aggressively dismantling its sprawling South American retail footprint in [...]

Via Finterra · February 24, 2026

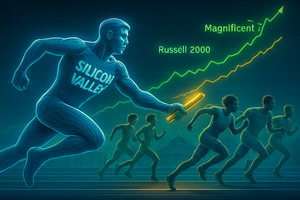

The financial landscape of 2026 has opened with a dramatic shift in market leadership, as small-cap stocks stage a historic rally that has left large-cap tech giants in the rearview mirror. After years of dominance by a handful of "Magnificent 7" companies, the tide has turned toward the "median stock,

Via MarketMinute · February 23, 2026

The U.S. Department of Commerce released a sobering report today, February 20, 2026, revealing that the American economy slowed to a crawl in the final months of 2025. According to the Bureau of Economic Analysis (BEA), Real Gross Domestic Product (GDP) increased at an annual rate of 1.4%

Via MarketMinute · February 20, 2026

Growth is oxygen.

But when it evaporates, the consequences can be severe - ask anyone who bought Cisco in the Dot-Com Bubble or newer investors who lived through the 2020 to 2022 COVID cycle.

Via StockStory · February 16, 2026

As of mid-February 2026, a profound shift is rattling the foundations of Wall Street. For over a decade, the narrative of the American stock market was one of extreme concentration, dominated by a handful of mega-cap technology titans that propelled indices to record highs. However, the tide has officially turned.

Via MarketMinute · February 16, 2026

The United States banking sector has entered a transformative era of consolidation in early 2026, with merger and acquisition (M&A) activity reaching levels not seen since 2019. Driven by a "perfect storm" of regulatory clarity, the urgent need for technological scale, and a hunt for stable deposit bases, the

Via MarketMinute · February 16, 2026

In a move that signals a seismic shift in the American banking landscape, Fifth Third Bancorp (Nasdaq: FITB) has officially completed its $12.3 billion acquisition of Comerica Incorporated (NYSE: CMA). Finalized on February 2, 2026, the merger creates the ninth-largest bank in the United States, commanding approximately $294 billion

Via MarketMinute · February 16, 2026

KeyCorp’s 18.2% return over the past six months has outpaced the S&P 500 by 12.3%, and its stock price has climbed to $21.50 per share. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Via StockStory · February 15, 2026

The financial landscape shifted violently this week as the long-dormant Russell 2000 index (INDEXRUSSELL:RUT) staged a breathtaking 18% rally, marking its best single-week performance in decades. Triggered by a surprisingly soft Consumer Price Index (CPI) report released on Wednesday, the surge has ignited what analysts are calling "The Great

Via MarketMinute · February 13, 2026

As the Q4 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the regional banks industry, including KeyCorp (NYSE:KEY) and its peers.

Via StockStory · February 12, 2026

The January Consumer Price Index (CPI) report, scheduled for release by the Bureau of Labor Statistics (BLS) on Friday, February 13, 2026, is being viewed as a critical "litmus test" for the Federal Reserve’s "soft landing" narrative. Following a period of significant economic volatility in late 2025, including a

Via MarketMinute · February 9, 2026

This underlying investment premise for AMD remains unchanged despite the company's light Q1 guidance.

Via The Motley Fool · February 6, 2026

Investors are increasingly bearish on the adtech specialist.

Via The Motley Fool · February 3, 2026

Market swings can be tough to stomach, and volatile stocks often experience exaggerated moves in both directions.

While many thrive during risk-on environments, many also struggle to maintain investor confidence when the ride gets bumpy.

Via StockStory · February 1, 2026

Concerns about slowing growth and a pricey valuation rocked the stock.

Via The Motley Fool · January 29, 2026

KeyCorp’s fourth quarter results outpaced Wall Street’s expectations, supported by double-digit revenue growth and disciplined expense management. Management credited the quarter’s performance to strong momentum in commercial and fee-based businesses, as well as continued investments in technology and talent. CEO Chris Gorman highlighted a focus on organic growth across middle market lending, investment banking, and wealth management, stating, “We added nearly 10% to our frontline banker staff across wealth management, commercial payments, middle market, and investment banking.” The company also reported improvements in asset quality and proactive deposit management, which helped optimize funding costs and maintain peer-leading capital ratios.

Via StockStory · January 27, 2026

As of January 26, 2026, the financial landscape has undergone a seismic shift, marking the definitive end of the "Magnificent 7" era of uncontested dominance. For the first time in decades, the baton of market leadership has been passed to the small-cap arena in what analysts are calling the "Earnings

Via MarketMinute · January 26, 2026