Intercontinental Exchange (ICE)

172.18

+0.28 (0.16%)

NYSE · Last Trade: Jan 22nd, 10:22 AM EST

Via MarketBeat · January 21, 2026

As of January 21, 2026, the financial landscape has undergone a seismic shift. While traditional equity analysts still pore over balance sheets, a new breed of institutional and retail traders is looking elsewhere for an informational edge: prediction markets. Once dismissed as a niche interest for political junkies, platforms like Polymarket and Kalshi have evolved [...]

Via PredictStreet · January 21, 2026

WASHINGTON, D.C. — January 20, 2026 — Exactly one year after Donald Trump was sworn in as the 47th President of the United States, a new kind of ticker tape is dominating the financial landscape. It isn't tracking the S&P 500 or the price of gold, but rather the specific syllables spoken by the Commander-in-Chief. [...]

Via PredictStreet · January 20, 2026

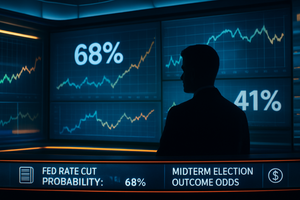

As the Federal Reserve prepares for its first policy meeting of 2026 on January 27–28, a significant shift has occurred in how the financial world anticipates interest rate decisions. The traditional dominance of professional economic surveys and even standard bond-market derivatives is being challenged by prediction markets like Kalshi and Polymarket. For the upcoming January [...]

Via PredictStreet · January 20, 2026

As the second year of the second Trump administration begins on this January 20, 2026, the political world is already looking toward the horizon of 2028. While traditional pundits often wait for the midterm results to declare favorites, prediction market traders have already reached a consensus. Vice President JD Vance has solidified his position as [...]

Via PredictStreet · January 20, 2026

In a move that has sent shockwaves through the burgeoning "information economy," Polymarket has officially staged its return to the United States. Following a multi-year exile by federal regulators, the world’s largest prediction market platform successfully bypassed the typical years-long licensing process by executing a strategic $112 million acquisition of QCX, a Commodity Futures Trading [...]

Via PredictStreet · January 20, 2026

LONDON — January 20, 2026 — In a milestone moment for global capital markets, pharmaceutical giant AstraZeneca (NYSE: AZN) has officially filed its formal notice of voluntary withdrawal from the Nasdaq Stock Market today. The move marks the final countdown for one of the most significant listing migrations in recent history, as

Via MarketMinute · January 20, 2026

A stock with low volatility can be reassuring, but it doesn’t always mean strong long-term performance.

Investors who prioritize stability may miss out on higher-reward opportunities elsewhere.

Via StockStory · January 19, 2026

In a move that fundamentally redraws the boundaries between fintech, information science, and artificial intelligence, Alphabet Inc. (NASDAQ: GOOGL) has officially announced the reclassification of regulated prediction markets as financial products rather than gambling entities. Effective January 21, 2026, this policy shift marks a definitive end to the "gray area" status of platforms like Kalshi [...]

Via TokenRing AI · January 19, 2026

As of mid-January 2026, the global financial landscape is witnessing a profound shift in how risk is priced and managed. Long dismissed as the domain of political junkies and speculators, prediction markets have officially entered the "Institutional Era." This morning, January 19, 2026, trading desks at major investment banks are no longer just looking at [...]

Via PredictStreet · January 19, 2026

As of January 18, 2026, the landscape of American finance is undergoing a seismic shift that few saw coming four years ago. Polymarket, once the "offshore pariah" of the prediction market world, has successfully executed a multi-step regulatory maneuver to return to the United States. Following a period of exile that began with a CFTC [...]

Via PredictStreet · January 18, 2026

The financial landscape shifted permanently in October 2025 when the Intercontinental Exchange (NYSE: ICE), the powerhouse parent of the New York Stock Exchange, announced a staggering $2 billion strategic investment into Polymarket. This move didn't just inject capital; it effectively minted prediction markets as the new "truth engine" of global finance. At the time of [...]

Via PredictStreet · January 18, 2026

On January 7, 2026, the global media landscape underwent a seismic shift that few traditional pundits saw coming. News Corp (Nasdaq: NWSA), the parent company of Dow Jones, announced an exclusive multi-year partnership with Polymarket, the world’s leading decentralized prediction platform. This alliance does more than just share data; it signals the definitive arrival of [...]

Via PredictStreet · January 17, 2026

As of January 17, 2026, the global financial landscape has fundamentally shifted. What were once dismissed as "gambling dens" for political junkies have evolved into the world’s most accurate "truth engines." The catalyst for this transformation can be traced back to a single, high-conviction figure from the 2024 U.S. election: the pseudonymous French trader known [...]

Via PredictStreet · January 17, 2026

Starting January 21, 2026, the landscape of digital information and financial speculation will undergo a seismic transformation. Alphabet Inc. (NASDAQ: GOOGL) has officially announced a major policy shift, reclassifying regulated prediction markets from "gambling" to "financial products." This change allows federally supervised platforms to advertise their services nationwide across Google’s massive search and display network, [...]

Via PredictStreet · January 17, 2026

In a move that signals a seismic shift for Wall Street’s most storied investment bank, Goldman Sachs (NYSE: GS) CEO David Solomon has officially signaled the firm’s intent to enter the rapidly maturing world of prediction markets. Speaking during the company’s Q4 2025 earnings call on January

Via MarketMinute · January 16, 2026

As of mid-January 2026, the landscape of broadcast journalism has fundamentally shifted. For decades, viewers tuned into news networks for opinions, expert "hot takes," and statistical polling that often lagged behind reality. That era ended this month. With the full-scale launch of landmark media partnerships between the regulated exchange Kalshi and news giants CNN (NASDAQ: [...]

Via PredictStreet · January 16, 2026

On January 12, 2026, the prediction market industry reached a historic milestone, processing a staggering $701.7 million in a single 24-hour trading session. This unprecedented volume represents a watershed moment for the sector, effectively transitioning event-based contracts from a niche curiosity into a primary "truth engine" for institutional and retail investors alike. The surge was [...]

Via PredictStreet · January 16, 2026

The world of decentralized finance is no stranger to "whales" and high-stakes gambles, but a single series of trades executed in the final hours of January 2, 2026, has sent shockwaves through Washington and the global prediction market industry. Just hours before U.S. Special Operations forces launched "Operation Absolute Resolve" to capture Venezuelan leader Nicolás [...]

Via PredictStreet · January 16, 2026

In the wake of the most heavily traded political event in history, a landmark study from Vanderbilt University has sent shockwaves through the burgeoning prediction market industry. The report, titled "Prediction Markets? The Accuracy and Efficiency of $2.4 Billion in the 2024 Presidential Election," reveals a startling inverse relationship between raw capital and predictive precision. [...]

Via PredictStreet · January 16, 2026

As of January 16, 2026, the global financial landscape has undergone a silent revolution. The speculative fever that once characterized prediction markets during election cycles has matured into a sophisticated infrastructure for risk management. Today, traders are no longer just betting on outcomes; they are using platforms like Kalshi and Polymarket to hedge against the [...]

Via PredictStreet · January 16, 2026

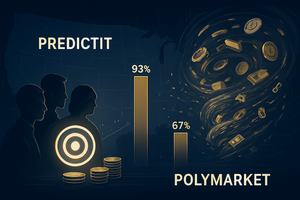

In the fast-evolving landscape of 2026 prediction markets, the conversation is often dominated by the massive volumes of crypto-native platforms or the retail explosion of regulated exchanges. Yet, as the primary season for the 2026 Midterm elections heats up, one name remains the essential dashboard for political professionals and junkies alike: PredictIt. Despite a decade [...]

Via PredictStreet · January 16, 2026

On any given night in early 2026, a viewer tuning into prime-time news is less likely to see a panel of political consultants arguing over "vibes" and more likely to see a glowing, fluctuating percentage at the bottom of the screen. As of January 16, 2026, the traditional news ticker has been permanently altered. The [...]

Via PredictStreet · January 16, 2026

In early 2026, the global financial landscape is undergoing a silent but profound restructuring. What were once dismissed as niche "betting" sites for political junkies have transformed into the "truth engine" of the modern economy. Prediction markets are no longer just speculative sideshows; they have emerged as core financial infrastructure, providing a real-time, incentivized layer [...]

Via PredictStreet · January 16, 2026

As of January 16, 2026, the global intelligence community is no longer looking solely at satellite imagery or diplomatic cables to gauge the risk of war in the Middle East. Instead, they are watching the order books. The concept of "Operation Iron Strike"—a rumored Israeli military operation against Iranian strategic sites—has moved from classified briefings [...]

Via PredictStreet · January 16, 2026