Amtech has gotten torched over the last six months - since September 2024, its stock price has dropped 20.2% to $4.89 per share. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Amtech, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Even though the stock has become cheaper, we're swiping left on Amtech for now. Here are three reasons why there are better opportunities than ASYS and a stock we'd rather own.

Why Do We Think Amtech Will Underperform?

Focusing on the silicon carbide and power semiconductor sectors, Amtech Systems (NASDAQ:ASYS) produces the machinery and related chemicals needed for manufacturing semiconductors.

1. Long-Term Revenue Growth Disappoints

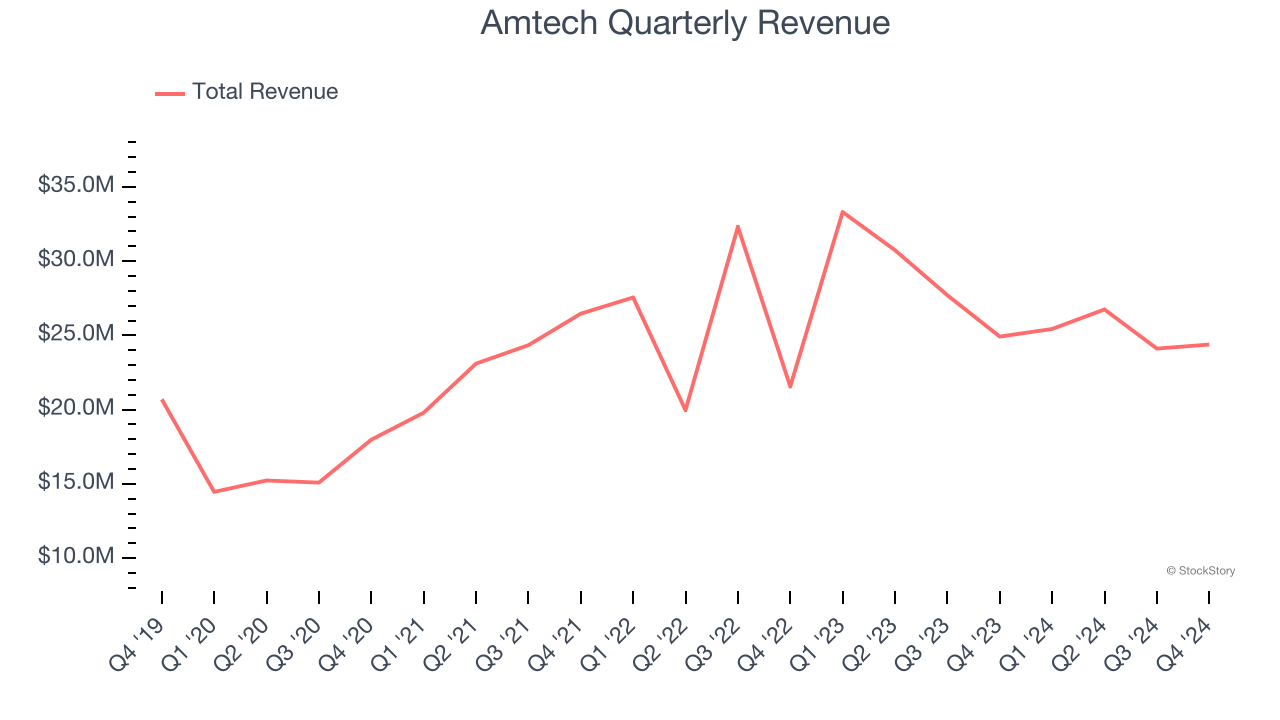

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Amtech grew its sales at a sluggish 4.1% compounded annual growth rate. This was below our standard for the semiconductor sector. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

2. Operating Losses Sound the Alarms

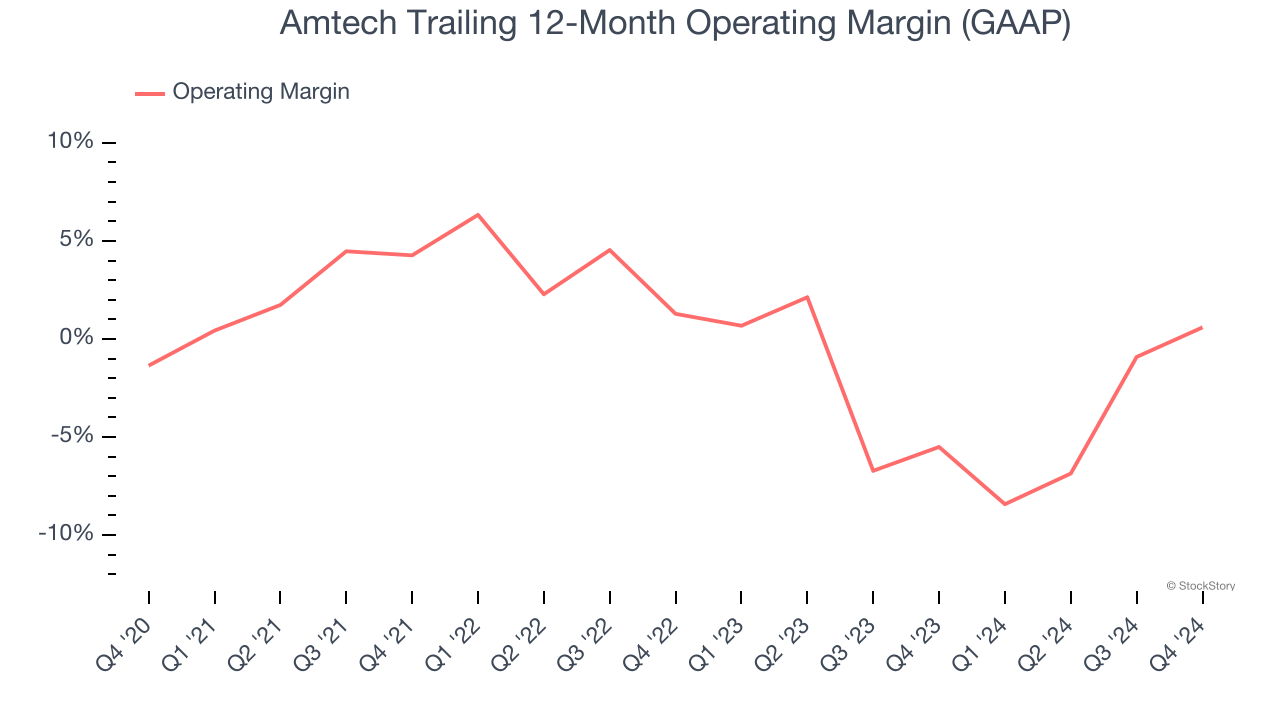

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Although Amtech was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 2.7% over the last two years. Unprofitable semiconductor companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

3. Previous Growth Initiatives Have Lost Money

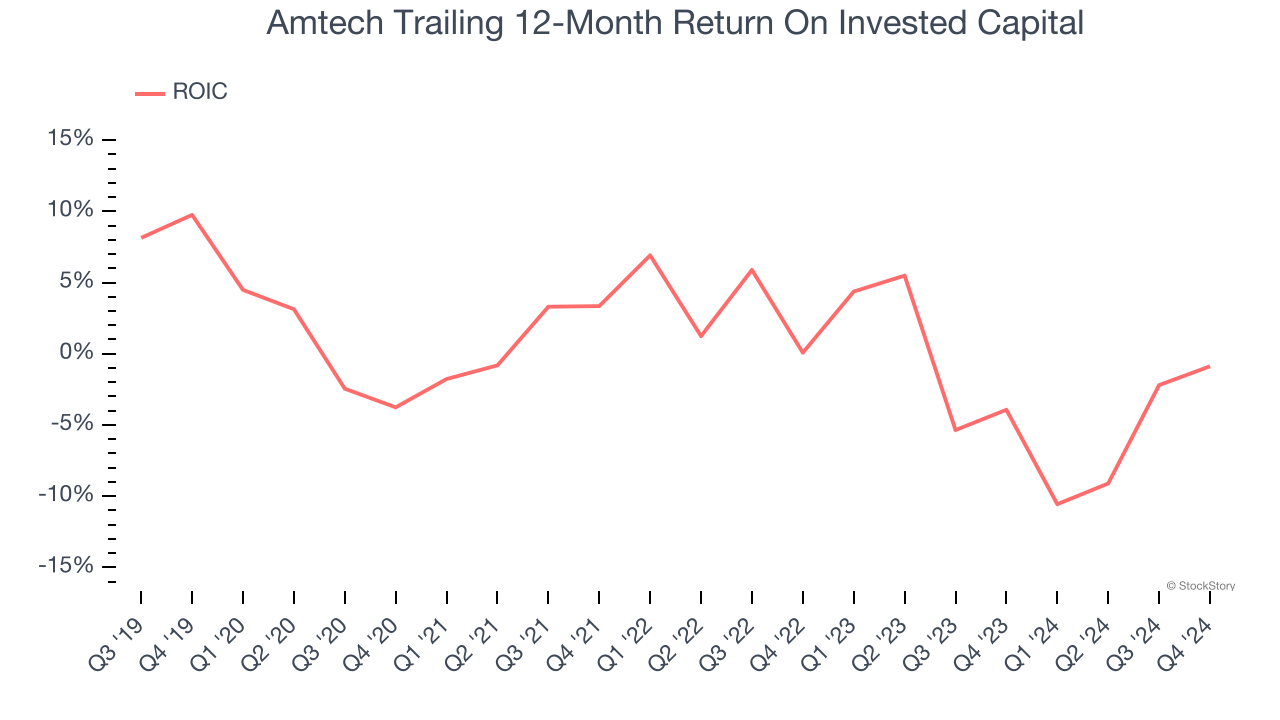

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Amtech’s five-year average ROIC was negative 1%, meaning management lost money while trying to expand the business. Its returns were among the worst in the semiconductor sector.

Final Judgment

We cheer for all companies solving complex technology issues, but in the case of Amtech, we’ll be cheering from the sidelines. Following the recent decline, the stock trades at 10.2× forward EV-to-EBITDA (or $4.89 per share). This valuation tells us a lot of optimism is priced in - we think there are better opportunities elsewhere. We’d suggest looking at one of our top digital advertising picks.

Stocks We Like More Than Amtech

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.