Looking back on transportation and logistics stocks’ Q4 earnings, we examine this quarter’s best and worst performers, including Norfolk Southern (NYSE:NSC) and its peers.

The growth of e-commerce and global trade continues to drive demand for shipping services, presenting opportunities for transportation and logistics companies. The industry continues to invest in advanced technologies such as automated sorting systems and real-time tracking solutions to enhance operational efficiency. Companies that win in this space boast speed, reach, reliability, and last-mile efficiency while those who do not see their market shares diminish. Like other industrials companies, transportation and logistics companies are at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs influence profit margins.

The 29 transportation and logistics stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 0.6%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 12.9% since the latest earnings results.

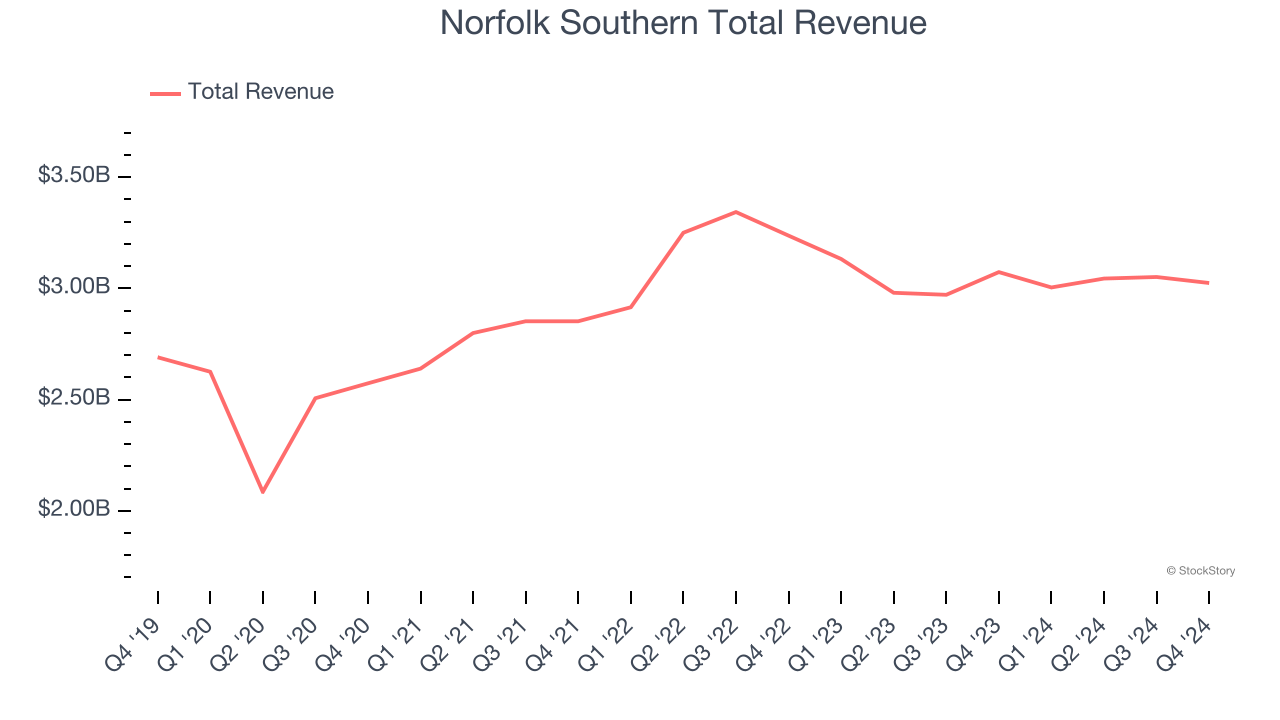

Norfolk Southern (NYSE:NSC)

Starting with a single route from Virginia to North Carolina, Norfolk Southern (NYSE:NSC) is a freight transportation company operating a major railroad network across the eastern United States.

Norfolk Southern reported revenues of $3.02 billion, down 1.6% year on year. This print was in line with analysts’ expectations, and overall, it was a satisfactory quarter for the company with a decent beat of analysts’ adjusted operating income estimates.

The stock is down 7.1% since reporting and currently trades at $234.50.

Is now the time to buy Norfolk Southern? Access our full analysis of the earnings results here, it’s free.

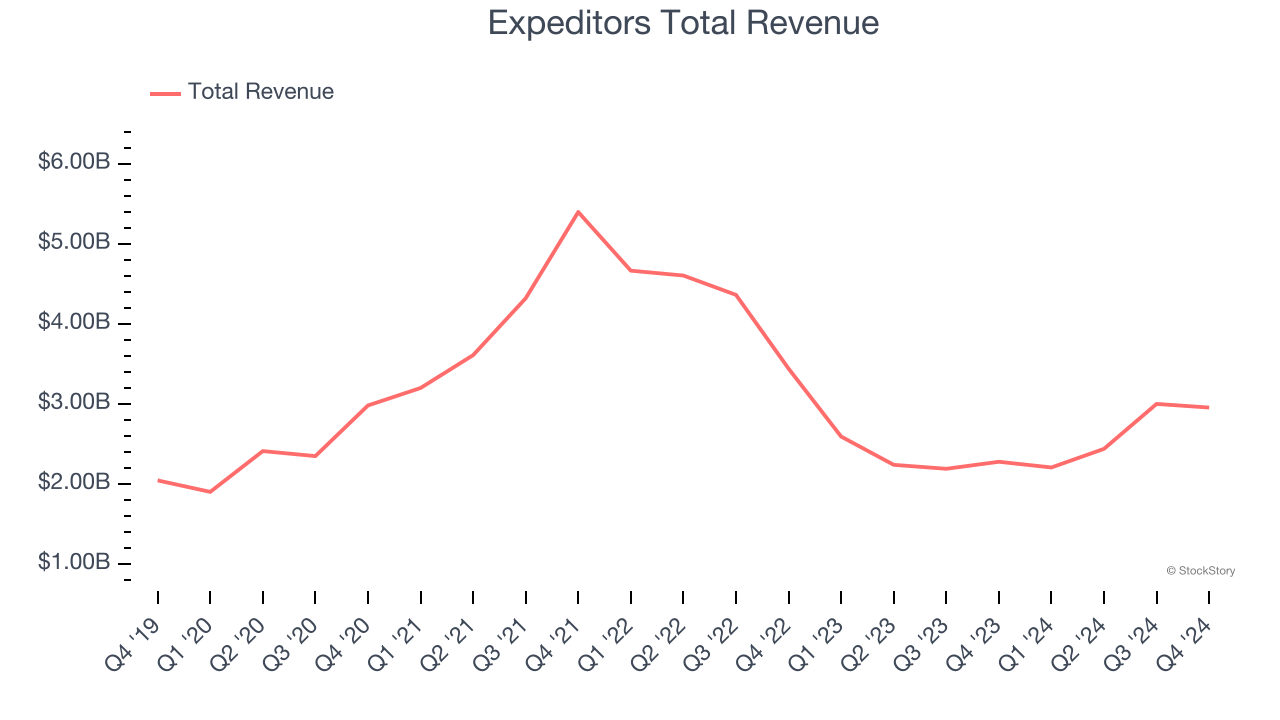

Best Q4: Expeditors (NYSE:EXPD)

Expeditors (NYSE:EXPD) offers air and ocean freight as well as brokerage services.

Expeditors reported revenues of $2.95 billion, up 29.7% year on year, outperforming analysts’ expectations by 4.3%. The business had a stunning quarter with an impressive beat of analysts’ EBITDA estimates.

The market seems content with the results as the stock is up 2.8% since reporting. It currently trades at $116.95.

Is now the time to buy Expeditors? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Avis Budget Group (NASDAQ:CAR)

The parent company of brands such as Zipcar and Budget Truck Rental, Avis (NASDAQ:CAR) is a provider of car rental and mobility solutions.

Avis Budget Group reported revenues of $2.71 billion, down 2% year on year, falling short of analysts’ expectations by 1%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income estimates.

As expected, the stock is down 31.5% since the results and currently trades at $61.50.

Read our full analysis of Avis Budget Group’s results here.

Landstar (NASDAQ:LSTR)

Covering billions of miles throughout North America, Landstar (NASDAQ:LSTR) is a transportation company specializing in freight and last-mile delivery services.

Landstar reported revenues of $1.21 billion, flat year on year. This result surpassed analysts’ expectations by 1.1%. Taking a step back, it was a softer quarter as it logged a significant miss of analysts’ adjusted operating income estimates.

The stock is down 12.4% since reporting and currently trades at $151.59.

Read our full, actionable report on Landstar here, it’s free.

U-Haul (NYSE:UHAL)

Founded by a husband and wife duo, U-Haul (NYSE:UHAL) is a provider of rental trucks and storage facilities.

U-Haul reported revenues of $1.39 billion, up 3.7% year on year. This number topped analysts’ expectations by 3.1%. More broadly, it was a mixed quarter as it recorded a significant miss of analysts’ EPS estimates.

The stock is down 12.6% since reporting and currently trades at $62.53.

Read our full, actionable report on U-Haul here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.