STERIS currently trades at $226.40 per share and has shown little upside over the past six months, posting a small loss of 4.5%.

Is there a buying opportunity in STERIS, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

We don't have much confidence in STERIS. Here are three reasons why there are better opportunities than STE and a stock we'd rather own.

Why Is STERIS Not Exciting?

With a mission critical role in preventing healthcare-associated infections, STERIS (NYSE:STE) provides infection prevention products, sterilization services, and medical equipment that help healthcare facilities and life science companies maintain sterile environments.

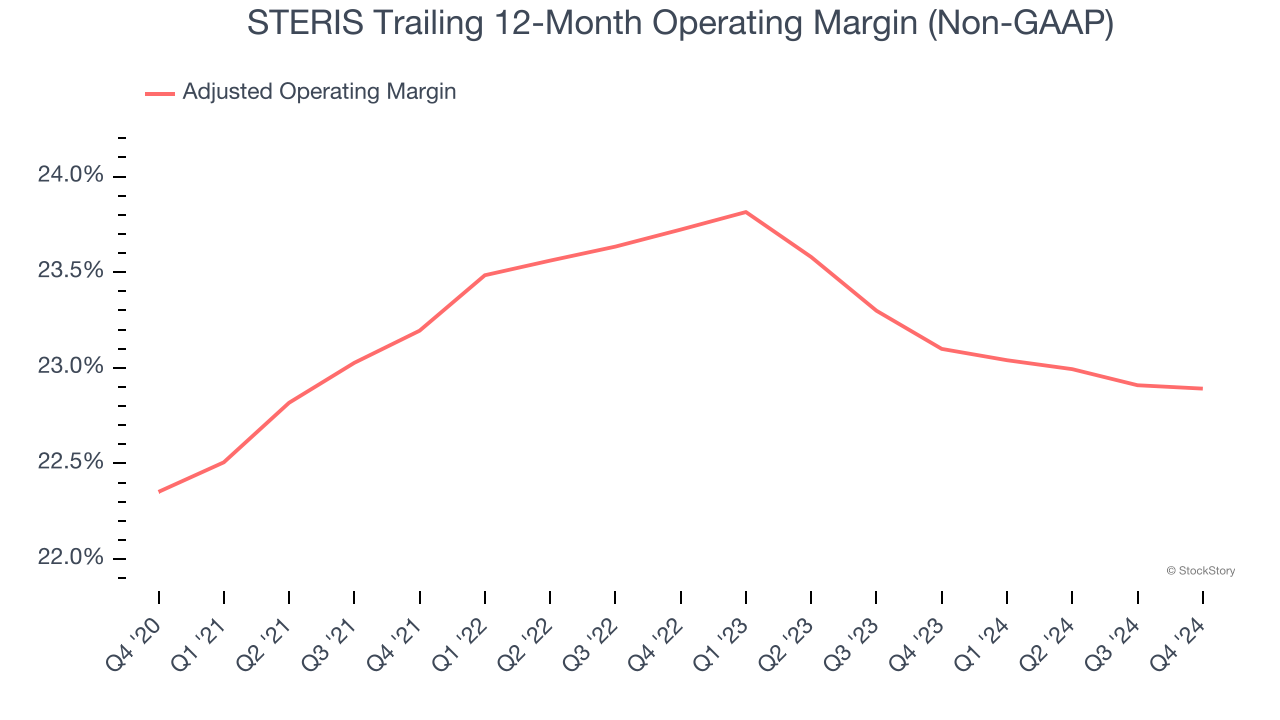

1. Adjusted Operating Margin in Limbo

Adjusted operating margin is a key measure of profitability. Think of it as net income (the bottom line) excluding the impact of non-recurring expenses, taxes, and interest on debt - metrics less connected to business fundamentals.

Looking at the trend in its profitability, STERIS’s adjusted operating margin might fluctuated slightly but has generally stayed the same over the last two years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Its adjusted operating margin for the trailing 12 months was 22.9%.

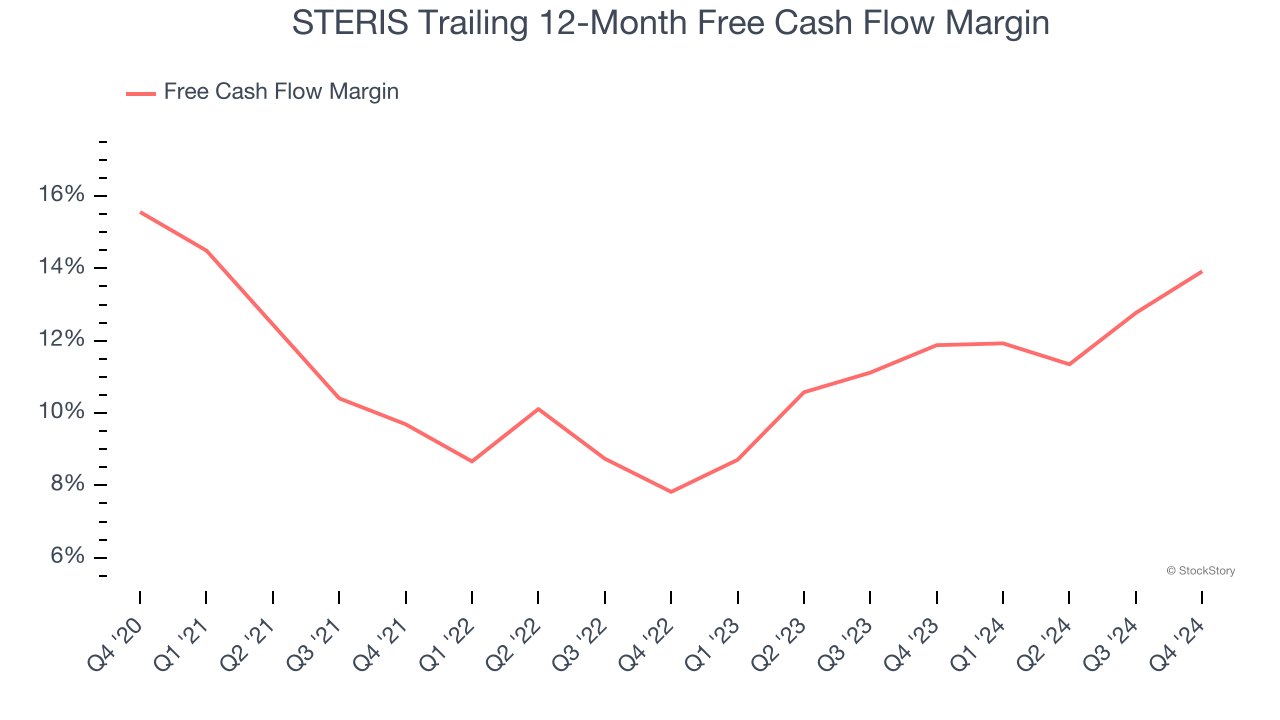

2. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, STERIS’s margin dropped by 1.6 percentage points over the last five years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. If the longer-term trend returns, it could signal increasing investment needs and capital intensity. STERIS’s free cash flow margin for the trailing 12 months was 13.9%.

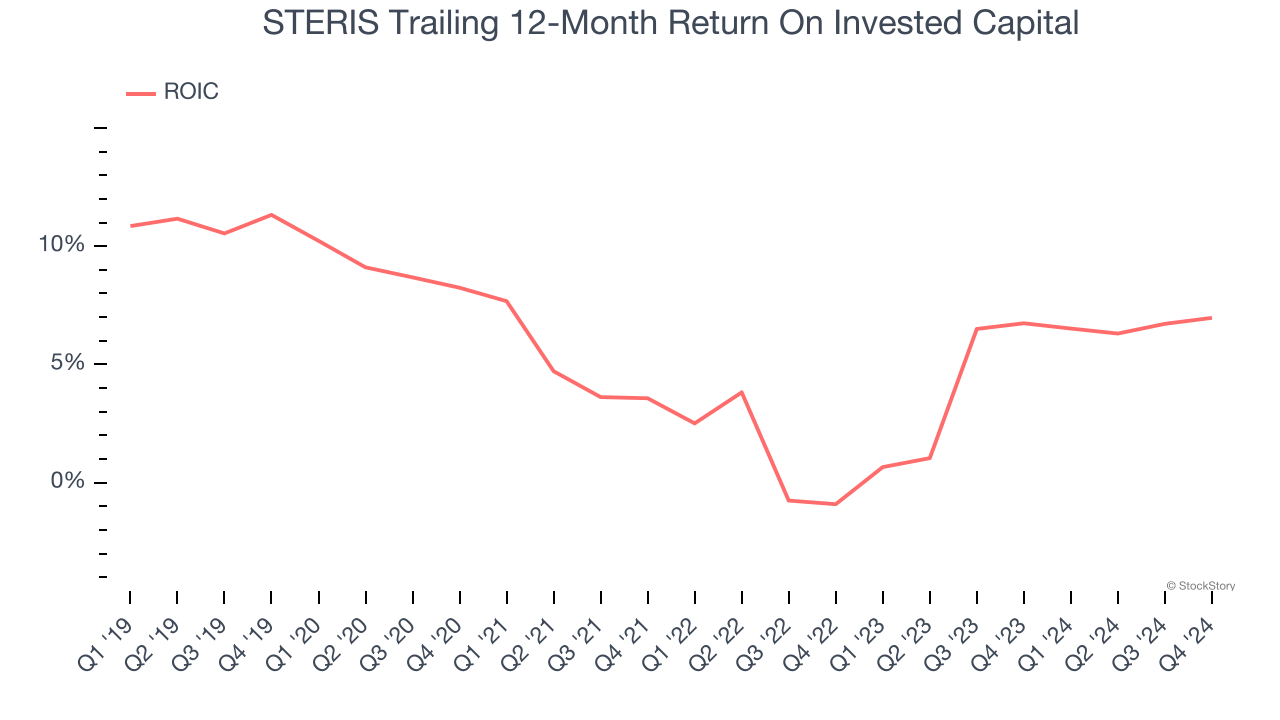

3. Previous Growth Initiatives Haven’t Impressed

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

STERIS historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 4.9%, lower than the typical cost of capital (how much it costs to raise money) for healthcare companies.

Final Judgment

STERIS isn’t a terrible business, but it isn’t one of our picks. That said, the stock currently trades at 23× forward price-to-earnings (or $226.40 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better stocks to buy right now. We’d recommend looking at one of our top software and edge computing picks.

Stocks We Like More Than STERIS

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.