Shareholders of PlayStudios would probably like to forget the past six months even happened. The stock dropped 20.7% and now trades at $1.19. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy PlayStudios, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

Despite the more favorable entry price, we don't have much confidence in PlayStudios. Here are three reasons why we avoid MYPS and a stock we'd rather own.

Why Do We Think PlayStudios Will Underperform?

Founded by a team of former gaming industry executives, PlayStudios (NASDAQ:MYPS) offers free-to-play digital casino games.

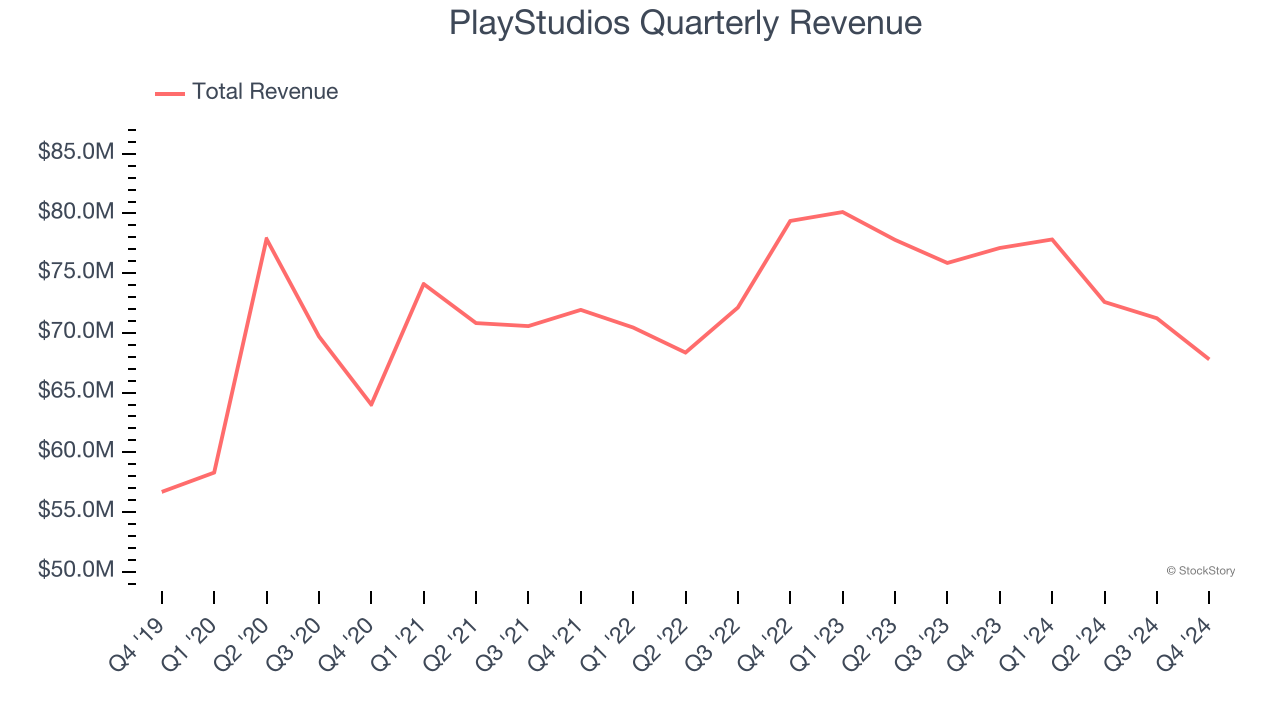

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, PlayStudios’s sales grew at a weak 1.8% compounded annual growth rate over the last four years. This fell short of our benchmarks.

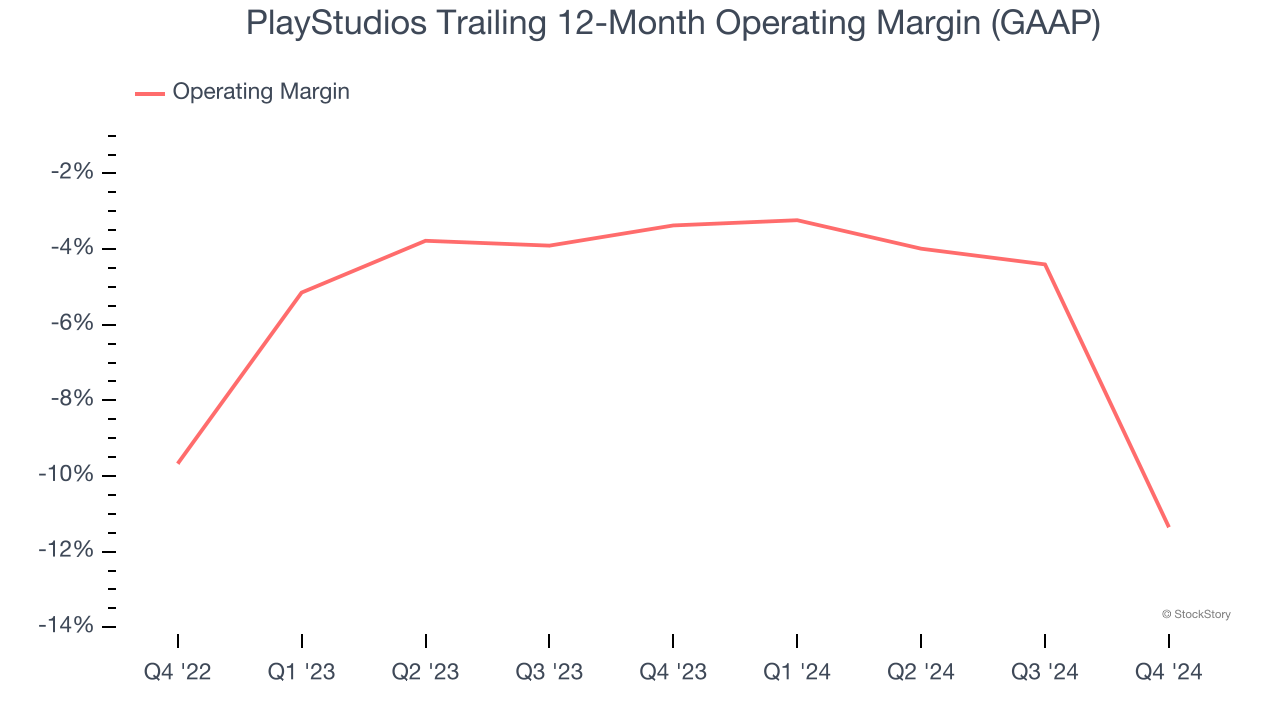

2. Operating Losses Sound the Alarms

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

PlayStudios’s operating margin has been trending down over the last 12 months and averaged negative 7.2% over the last two years. Unprofitable consumer discretionary companies with falling margins deserve extra scrutiny because they’re spending loads of money to stay relevant, an unsustainable practice.

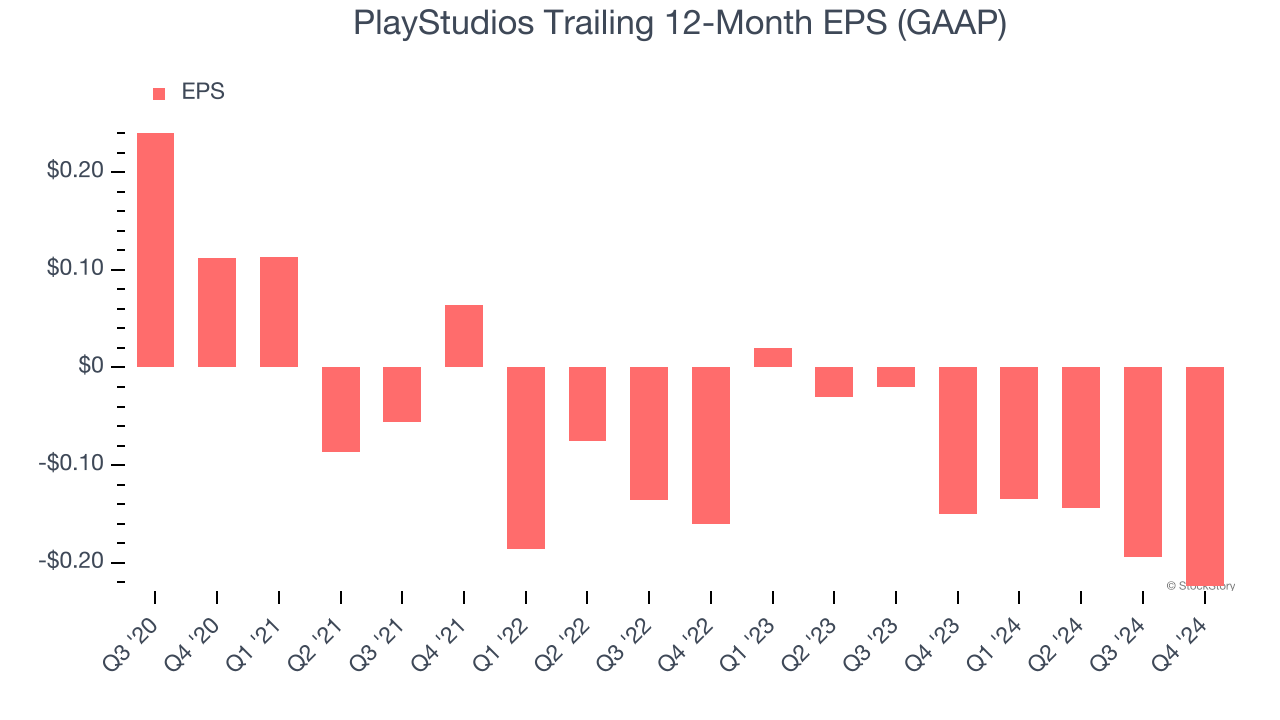

3. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for PlayStudios, its EPS declined by 41.4% annually over the last four years while its revenue grew by 1.8%. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

PlayStudios doesn’t pass our quality test. After the recent drawdown, the stock trades at 2.4× forward EV-to-EBITDA (or $1.19 per share). This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are more exciting stocks to buy at the moment. We’d recommend looking at a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Would Buy Instead of PlayStudios

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.